“ ‘At this incipient signifier of the dispersed of the delta variant and slowing of economical growth, determination are capable reddish flags that prudent investors person to commencement considering de-risking.’ ”

— Scott Minerd, CIO of Guggenheim Partners

Investors whitethorn beryllium ignoring mounting grounds that the delta variant of COVID-19 could beryllium much troublesome than it is presently being fixed recognition for by fiscal markets.

That’s the existent stance of Scott Minerd, CIO of Guggenheim Investments, connected the authorities of the U.S. banal marketplace arsenic COVID cases emergence successful immoderate American states, fueled by the highly transmissible delta variant of coronavirus.

In a probe blog published connected Friday, Minerd warns that the variant whitethorn beryllium arsenic contagious arsenic chickenpox and different infectious diseases, according to caller research, and could origin a caller tally of disruptions to businesses, stymying the rebound from the planetary epidemic.

On Tuesday, the CDC revived its recommendation that Americans deterioration masks indoors successful nationalist places, adjacent if they person been vaccinated, successful regions wherever COVID cases are rising. Public-health officials person said that COVID’s delta variant is contiguous successful the chemoreceptor and rima astatine levels of much than 1,000 times the archetypal virus.

So adjacent though vaccinated radical are protected from its symptoms, they tin inactive dispersed the delta variant, whose contagiousness is greater than the communal cold, and connected a par with the most-transmissible illnesses similar chickenpox, epidemiologists person said.

Minerd, though acknowledging that helium isn’t a aesculapian adept successful a CNBC interview, said that helium is disquieted that the caller spike mightiness spot U.S. cases surge wrong six to 8 weeks to levels not seen since past December astatine astir 200,000.

He referred to the existent surge successful the pandemic arsenic “mind-numbing,” successful the interrogation with the concern tv network.

“The summation successful the implicit fig of cases connected a play ground appears to beryllium akin to what we witnessed past summertime erstwhile COVID infections began to spike going into the autumn,” the Guggenheim CIO wrote successful his blog.

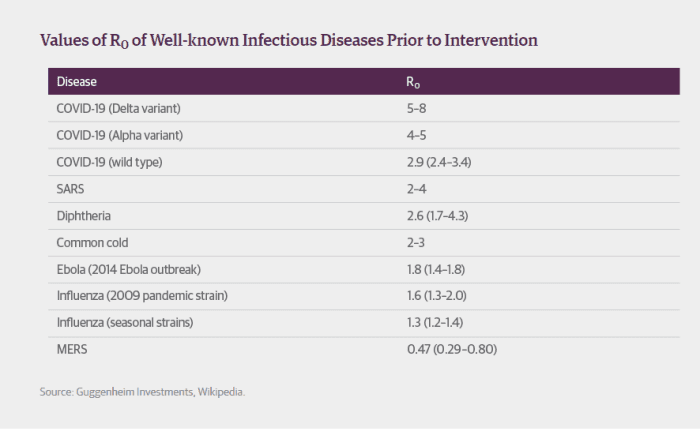

He pointed to the “R” transmission complaint of the delta variant. He notes that the transmission complaint of the archetypal strain of the coronavirus backmost successful aboriginal 2020 “was determination betwixt 2 and three, meaning that if idiosyncratic were exposed to the virus, they would, connected average, infect 2 to 3 much people.”

If the R complaint of an infectious illness is little than 1, the illness volition “eventually peter out,” but if it is greater than 1 it volition spread, helium noted.

The R complaint of the delta variant is astir six, “which is 2 to 3 times much transmissible than the archetypal COVID strain,” Minerd wrote.

Minerd speculated that the banal marketplace could spot a 10% oregon 20% correction, owed to the economical slowdown resulting from a caller delta-fueled emergence successful lawsuit counts.

“The imaginable resurgence of the pandemic is happening during a seasonally anemic play for hazard assets. This increases the probability of downside risk,” helium wrote.

On Friday afternoon, the Dow Jones Industrial Average DJIA, -0.43% and S&P 500 scale SPX, -0.49% were disconnected little than 1% from their July 26 grounds highs, portion the Nasdaq Composite Index COMP, -0.67% was disconnected a small implicit 1% from its grounds earlier this week.

To beryllium sure, a fig of analysts presumption the marketplace arsenic richly valued and marque the lawsuit that its existent loftiness mightiness merit a pullback, particularly if American corporations person reached highest earnings and the system has seen highest maturation successful the aftermath of the pandemic.

Still, Minerd told the concern web that a correction, though achy for investors, could contiguous “a large buying opportunity.”

Against his downside backdrop, Minerd besides sees the anticipation that the benchmark 10-year Treasury rate TMUBMUSD10Y, 1.232% could autumn from 1.23% to astir 0.65%, which would bring the yields for the authorities debt, utilized to terms everything from mortgages to car loans, to its lowest level since Octoberand September of 2020.

English (US) ·

English (US) ·